Table of Contents

As companies around the world work towards carbon neutrality, many governments are implementing carbon taxes, which place a price on carbon, a greenhouse gas, in an effort to reduce industrial carbon emissions. This has proven to be a fairly effective form of emissions mitigation, and when enacted properly, can have significant impacts on improving sustainable options for consumers.

The implementation of carbon taxes will have wide-reaching effects, not only in reducing carbon emissions from industries, but also in creating more transparent supply chains for more ethically and environmentally responsible business practices.

As consumers, it’s important to understand the environmental impacts of the companies you support. Carbon taxes are one way to increase business’ transparency and make global production a little bit greener.

Carbon taxes come with their fair share of critiques and misconceptions. This article explains everything you need to know about carbon taxes, from what are their effects on limiting greenhouse gas emissions from supply chains, to how supply chains can in turn be impacted by carbon taxes.

Carbon Taxes

Industries are one of the biggest contributors to global climate change, with industrial carbon emissions driving rising temperatures more than any other sector. Carbon taxes seek to mitigate these effects through set prices and fees that incentivize companies to lower emissions.

Image Source: Wikipedia

Under a carbon tax, governments establish fees for emitters to pay based on the greenhouse gasses they release per ton emitted. The effects of these taxes work their way up supply chains, resulting in higher prices for fuels, oils, and gasses that incentivize companies and consumers to look for greener alternatives. This leads to companies changing their fossil fuels, adopting new energy sources and technologies, and shopping sustainably to avoid higher prices.

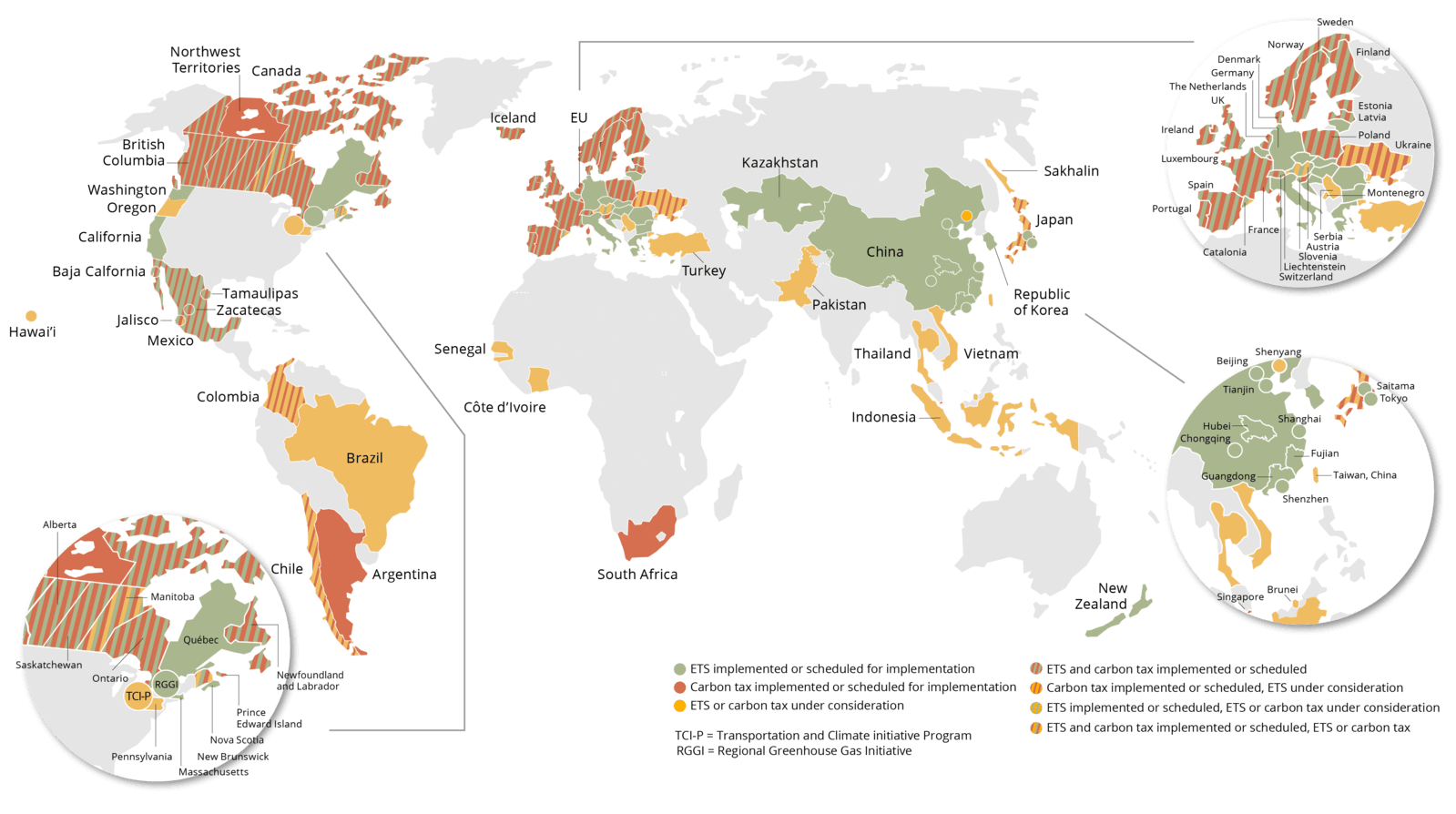

As of 2022, no states in the US have implemented an official carbon tax, although California and eleven states in the northeast have implemented cap-and-trade carbon pricing strategies similar to a carbon tax. Many other countries around the world have also begun adopting some form of carbon mitigation incentives, including Canada, China, the European Union (which comprises 27 countries), and the UK. The EU has even begun implementing a carbon-border tax, which charges goods imported from countries with fewer carbon emission regulations.

Carbon taxes have proven to be one of the most effective methods of mitigating carbon emissions from baseline sources. In Sweden, which first introduced its carbon tax in 1991, carbon emissions have dropped by 11% in transportation alone.

This helps drastically reduce carbon emissions from its baseline sources as companies and consumers change their consumption practices to avoid taxes. In addition, carbon taxes result in companies reassessing their supply chains.

By addressing carbon emissions from the ground up, carbon taxes push companies to full supply chain transparency, resulting in greener, more ethically responsible value chains that can drastically improve business practices.

How Supply Chains Contribute To Carbon Emissions

The vast majority of carbon emissions stem from a company’s value chain rather than the direct impacts of the business. A value chain consists of all the activities, products, and services needed to keep a business running.

Carbon emissions from a company’s value chain are known as Scope 3 emissions, and can often be one of the most influential and overlooked areas of emissions reductions.

Upstream emissions, including all those that stem from suppliers, typically include carbon emissions from:

- Resource harvesting and refinement

- Transportation of materials

- Waste

- Fuel and energy

- Leased assets

Downstream emissions occur after the company has produced the good, and typically include:

- Energy consumption from the product

- Product distribution

- Packaging

- Product’s end of life disposal

These sources can have severe impacts on emissions, as well as pollution and human health, but are rarely tracked by companies trying to mitigate their climate impacts. By working with carbon taxes, companies would have much greater incentives to reevaluate their value chains and ensure sustainability in every facet of the business.

What Are The Effects Of Carbon Taxes On Supply Chains

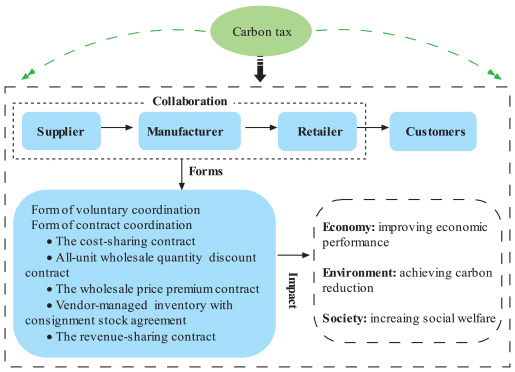

Image Source: Science Direct

Currently, one of the biggest issues with supply chain sustainability is a severe lack of transparency from businesses. Studies indicate that only 8.3% of US companies can boast full supply chain transparency. This results in higher greenhouse gas emissions and unethical business operations, where companies lack input on the manufacturing operations for their own products.

By enforcing carbon taxes, prices would rise from the bottom of the supply chain and work their way up. Companies would be incentivized to find different providers to avoid carbon taxes and extra fees, and would ultimately lead to greener supply networks and more communication between suppliers and business operators.

Opening up supply chain communication can have profound impacts not only on industrial sustainability, but on business performance as well. By identifying top tier suppliers and gauging performance levels across networks, companies can ensure that their providers maintain sustainable, ethical, and efficient practices.

In cases of border taxes, supply chain transparency could extend to increased communication with international suppliers, which vary in sustainability and social efforts across the world. By incentivizing businesses to search for greener providers, carbon taxes would potentially bring unsustainable suppliers to more environmentally conscious practices. This would lead to improved business practices, including:

- Renewable energy sources

- Environmental and ethical sourcing certifications and audits for safer, more sustainable factories

- Biodegradable and recyclable materials in packaging

- Minimized long-distance distribution

- Using recycled or biodegradable materials to ensure sustainable product manufacturing

What Are The Effects Of Carbon Taxes On Consumers

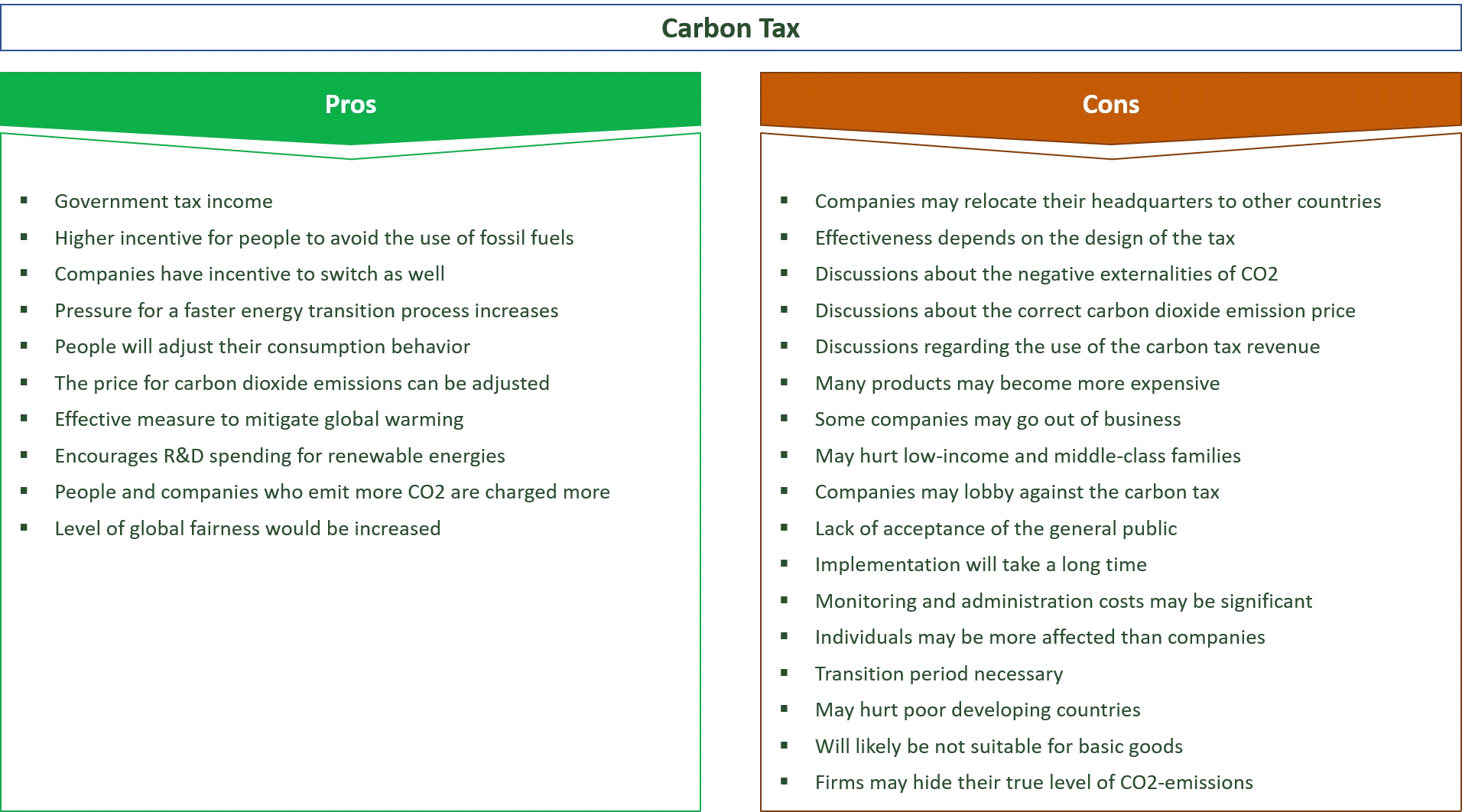

While carbon taxes have shown to be an effective method of cutting carbon emissions, one of the prominent arguments against them is that they will result in higher prices on products, effectively forcing the tax onto consumers and disproportionately impacting poorer households.

Image Source: EnvironmentalConscience.com

However, studies have shown that if implemented correctly, a carbon tax would place the burden on the capital, not the consumer, and thus do not actually raise prices for customers. Many carbon taxes around the world mitigate higher prices and disproportionate costs on consumers with recycled tax revenues that fund other rebate programs. A study conducted by the US Department of the Treasury in 2017 found that carbon taxes would pull in a net $1.9 billion over the course of ten years that would be transferred to household dividends and tax cuts as well as contribute to green investments.

Additionally, carbon taxes in the US are predicted to shift consumer interest away from taxed products, resulting in more energy-efficient and sustainable options in the long term. A well-designed carbon tax would not only promote supply chain transparency in international supply networks, but would push the global market towards sustainability.

Initially, prices may raise and affect consumers more than we would like, but as companies adjust to greener practices and consumers adjust their purchases, the costs of sustainability will taper out and bring us into a greener global market.

If you want to learn more about how carbon emissions affect our planet and what each one of us can do to lead a more sustainable lifestyle, follow our blog.

You might also enjoy:

1 comment

Carbon taxes are a game changer for supply chain transparency. It’s about time companies were held accountable for their environmental impact from start to finish.

visit our more info website

https://dezwaans.com.au/